- Blog

- > About Admissions Consultants

The Changing Face of College Admissions at America’s Top Public Universities

- Dr. Rachel Rubin

- | June 20, 2025

Over the past decade, a remarkable transformation has quietly reshaped the landscape of American public higher education. State flagship universities—institutions originally founded to provide accessible education to their residents—have increasingly positioned themselves as elite national universities, competing directly with the most selective private institutions for students, prestige, and rankings.

Our comprehensive study analyzed Common Data Sets from 2021, 2022, 2023, and 2024 for leading public universities across the country, comparing application volumes, acceptance rates, yield rates, and enrollment figures between 2021 and 2024. The findings reveal a dramatic shift: applications have surged by as much as 57% at some public universities, acceptance rates have plummeted, and enrollment strategies have become increasingly sophisticated and selective.

As these institutions pursue prestige and rankings, they are fundamentally reimagining their missions, priorities, and the populations they serve. The data tells a compelling story of public universities deliberately engineering greater selectivity through various enrollment management tactics—sometimes at the expense of their historical access mission.

An Unprecedented Surge in Applications

In the span of just four academic years, America’s top public universities have experienced an application boom that has fundamentally altered the higher education landscape. What was once a steady, predictable flow of applications has transformed into a torrent, with some institutions seeing their applicant pools expand by more than 50 percent between 2021 and 2024.

Record-Breaking Growth Across the Board

The numbers tell a striking story of transformation:

- University of Illinois: Applications skyrocketed from 47,527 to 74,742—a staggering 57.2% increase. In just three years, Illinois added over 27,000 new applicants, equivalent to adding the entire applicant pool of a mid-sized university.

- University of Washington: Applications surged by 41.6%, growing from 48,840 to 69,166. This represents more than 20,000 additional students competing for roughly the same number of spots.

- Purdue University: Once considered a reliable option for strong students, Purdue saw applications jump by 33%, from 59,173 to 78,745—bringing nearly 20,000 new competitors into the admissions pool.

- Georgia Institute of Technology: Applications increased by 31.7%, from 45,388 to 59,789, cementing its position as one of the most sought-after technical institutions in the country.

- University of Michigan: Already starting from a high baseline of nearly 80,000 applications in 2021, Michigan saw its applicant pool grow by another 23.3% to 98,310—approaching the symbolic 100,000 application threshold that was once the exclusive domain of the University of California system.

- University of Wisconsin-Madison: Applications grew by 22.47%, from 53,829 to 65,922, as the flagship Midwestern university’s reputation continued to expand nationally.

Driving Forces Behind the Surge

This explosive growth isn’t happening in a vacuum, but rather stems from several interconnected factors that have fundamentally reshaped the college application landscape.

First, public universities’ widespread adoption of the Common Application platform has dramatically lowered the barriers to applying to these schools. Students who might have submitted 5-7 applications a decade ago now routinely apply to 10-15 institutions with minimal additional effort, simply because the process has become so streamlined.

This ease of application has been further amplified by the test-optional revolution that emerged during the pandemic. As many institutions moved away from requiring standardized tests, a barrier that previously discouraged students from applying to more selective schools suddenly disappeared. Students who might have been hesitant to apply to competitive public universities due to test score concerns found themselves with newfound confidence to cast a wider net.

Meanwhile, the profile of public universities themselves has been steadily rising. As these institutions climb national rankings and garner “New Ivy“ media attention, they’ve entered the consideration set for high-achieving students who previously might have focused exclusively on private elite colleges.

This shift in perception has been reinforced by economic realities, as families increasingly view top public universities as an attractive value proposition. With private college tuition routinely exceeding $80,000 per year, prestigious public institutions offer an appealing alternative for students seeking academic excellence without the Ivy League price tag.

The appeal extends beyond domestic borders as well. American public flagships have become magnets for international students, a trend that many states actively encourage as they seek to grow out-of-state enrollment for financial reasons. This convergence of accessibility, affordability, and rising prestige has created a perfect storm driving unprecedented application volumes at public universities nationwide.

Related Article: How New Visa Restrictions Are Reshaping the College Admissions Landscape

The Cascading Effect

This application surge has created a self-reinforcing cycle. As applications increase, acceptance rates naturally fall. Lower acceptance rates boost an institution’s perceived selectivity, which attracts even more applications the following year. The University of Florida and Florida State University exemplify this pattern, having dramatically reduced their acceptance rates while simultaneously rising in national rankings.

For students and families, the implications are profound. Public universities that once represented reliable options for strong in-state students have transformed into highly selective institutions. The University of Texas-Austin now admits just 10.13% of out-of-state applicants—a selectivity level on par with some Top 20-ranked schools.

Perhaps most tellingly, even as applications have surged, many of these institutions have not proportionally expanded their freshman classes. Purdue’s enrollment grew by 12.9%, but this increase pales in comparison to its 33% application growth. More dramatically, Florida State actually reduced enrollment by 23.15% while applications continued to climb.

The result is a fundamentally altered admissions landscape where the notion of a “safety school” among top public universities has virtually disappeared. For today’s applicants, the public university gauntlet has become nearly as daunting as the competition for elite private institutions—a transformation few would have predicted just a decade ago.

Acceptance Rate Freefall: The New Selectivity at Public Flagships

Based on our analysis of Common Data Sets, the transformation in selectivity has been both rapid and dramatic, fundamentally altering the character of institutions that once prided themselves on accessibility alongside excellence.

The Selectivity Shift in Numbers, 2021 to 2024

The data reveals a remarkable tightening of admissions standards across the board:

- Purdue University: Led the pack with a stunning 19% decrease in acceptance rate between 2021 and 2024. A university that once admitted the majority of qualified applicants has transformed into one of the most selective public institutions in the Midwest.

- University of Illinois at Urbana-Champaign: Experienced a 17.3% drop in acceptance rate between 2021 and 2024, despite its massive campus and large enrollment capacity. This precipitous decline reflects the institution’s rising national profile, particularly in engineering and computer science.

- University of Wisconsin-Madison: Reduced its acceptance rate by 15% between 2021 and 2024, making admission to this flagship increasingly competitive even for strong in-state students who might have considered it a reliable option just five years ago.

- University of Washington: Saw its acceptance rate fall by 14.5% between 2021 and 2024, with out-of-state applicants facing particularly steep odds. The Seattle location and strength in computer science and engineering have fueled this transformation.

- Florida State University: Engineered a 12.8% drop in acceptance rate between 2021 and 2024, bringing its overall admission rate to just 24.22%—a number once associated with elite private universities rather than public institutions.

- University of Michigan: While starting from an already selective position, Michigan still managed to reduce its acceptance rate by an additional 4.5%, continuing its long-term strategy of positioning itself as the “public Ivy.”

- Georgia Tech: Decreased its acceptance rate by 4.2%, with its selective engineering programs becoming increasingly difficult to access, especially for out-of-state applicants.

The In-State/Out-of-State Divide

Perhaps most revealing is the continued disparity between how these universities typically treat in-state versus out-of-state applicants, so out-of-state applicants should be aware:

- University of Texas-Austin: Maintains a dramatic split—37.72% acceptance for Texas residents versus just 10.13% for non-residents. This stark difference reflects both the state’s automatic admission policy for top Texas students and the university’s strategic use of out-of-state admissions as a selectivity lever.

- Florida State University: Shows a similar pattern with 31.85% acceptance for Floridians versus 16.58% for non-residents, illustrating how flagship universities use out-of-state admissions as their most selective category.

- University of Minnesota-Twin Cities: Presents an interesting counter-example, with in-state students (75.46% acceptance) facing slightly higher hurdles than out-of-state applicants (83.58% acceptance), likely reflecting strategic enrollment management to attract non-resident tuition dollars.

From Access to Exclusivity

Institutions founded with the explicit purpose of democratizing higher education for their state residents are increasingly embracing exclusivity as a virtue. The psychological effect on applicants has been profound—rejection from one’s state flagship, once relatively uncommon for strong students, has become a routine part of the application process.

For many public universities, the acceptance rate has become a prestige metric actively managed as part of institutional strategy. Florida State’s combination of falling acceptance rates (-12.8%) and deliberately reduced enrollment (-23.15%) provides perhaps the clearest example of a public university explicitly pursuing exclusivity as a goal.

The yield data adds another dimension to this story. Despite becoming significantly more selective, not all universities are seeing improvements in yield (the percentage of admitted students who choose to enroll). Both the University of Illinois (-0.46%) and the University of Washington (-1.19%) experienced slight declines in yield, suggesting that greater selectivity doesn’t automatically translate to increased desirability among admitted students.

By contrast, Purdue (+4.28%), Georgia Tech (+3.98%), and Wisconsin (+2.48%) all managed to improve their yield rates while becoming more selective—the golden combination in enrollment management that suggests these universities are both more difficult to get into and more attractive to those who are admitted.

For students and families navigating this new landscape, the implications are clear: the days of the “safety” flagship are largely over. Public universities that once represented reliable options for strong students have transformed into highly selective institutions that must be approached with the same strategic care once reserved for elite private colleges. For many middle-class families, this shift represents the loss of an important category of schools that once offered both quality and predictability in the increasingly high-stakes college admissions process.

Strategic Enrollment Decisions

Behind the ballooning application and selectivity metrics lies a calculated approach to enrollment management. Our analysis of Common Data Sets reveals that top public universities are making deliberate—and divergent—decisions about their optimal size and composition.

Strategic Growth: Expanding While Becoming More Selective

Several institutions have managed the seemingly contradictory feat of becoming more selective while simultaneously growing their student bodies:

- Stony Brook University-SUNY: Led the expansion trend with an 18.3% enrollment increase (3,416 → 4,042 students). This growth reflects SUNY’s strategic plan to elevate Stony Brook’s national profile while still fulfilling its access mission.

- North Carolina State University: Expanded enrollment by 14.8% (4,982 → 5,723 students), capitalizing on North Carolina’s population growth and the Research Triangle’s economic dynamism.

- Purdue University: Grew by 12.9% (10,157 → 11,467 students) while simultaneously becoming 19% more selective. This balanced approach has allowed Purdue to enhance its prestige while still expanding educational access—particularly in high-demand STEM fields where the university has strategically invested.

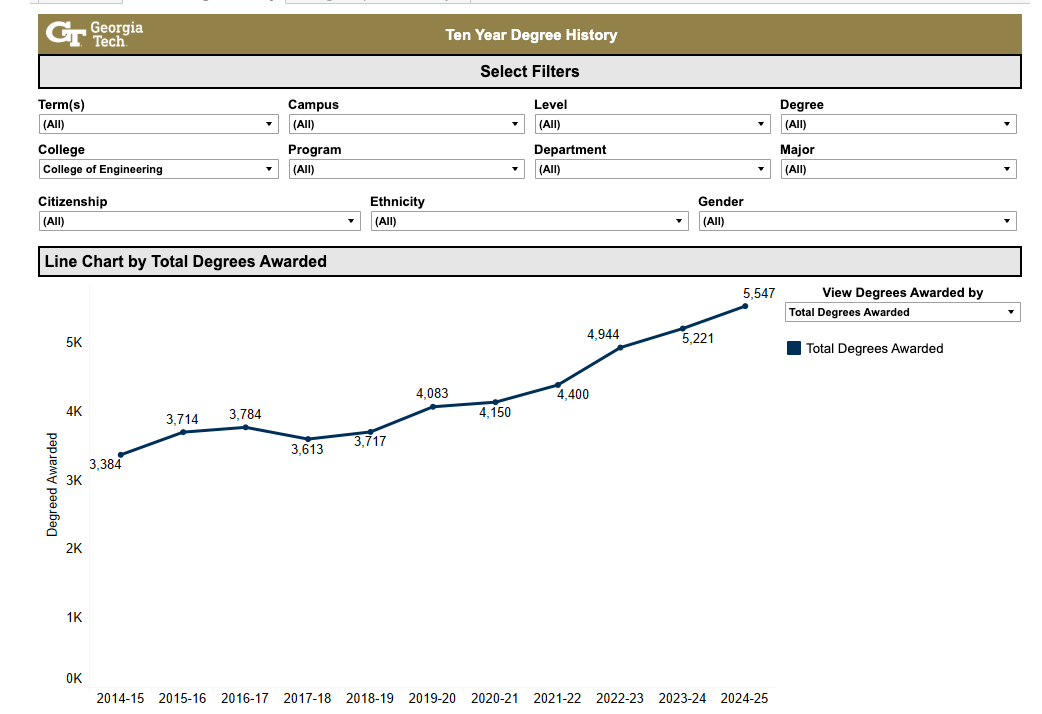

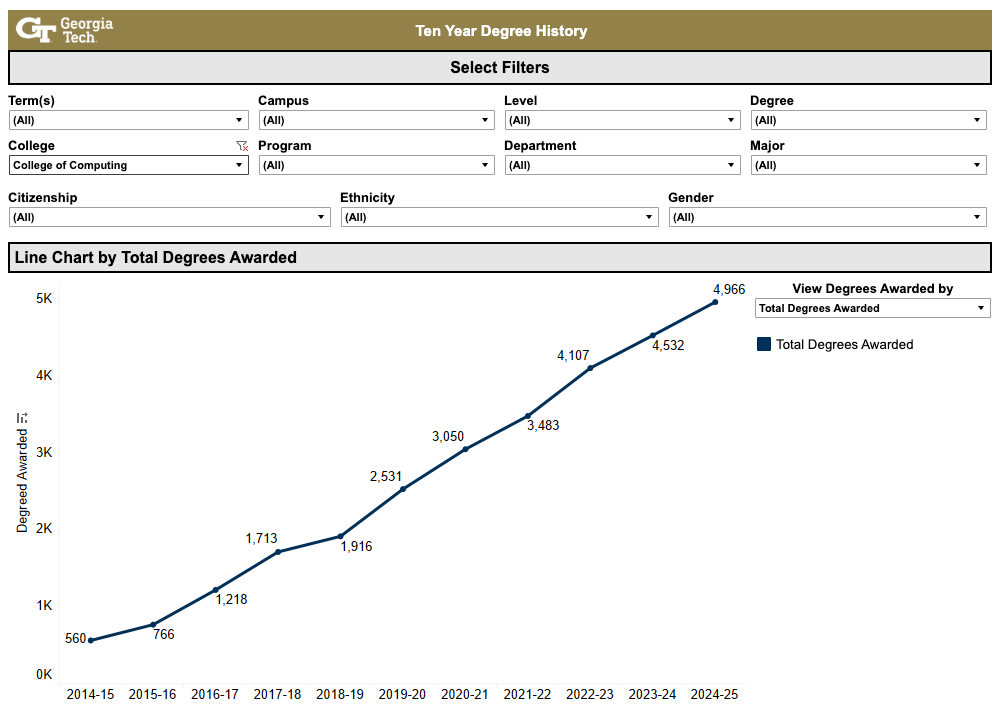

- Georgia Institute of Technology: Increased enrollment by 10.9% (3,471 → 3,850 students) while becoming moderately more selective. Georgia Tech’s growth has been particularly focused on computer science and engineering programs aligned with workforce needs. (See Fig. 1 and Fig. 2 below)

Fig. 1 – Georgia Tech College of Engineering Degrees Awarded (Source)

Fig. 2 – Georgia Tech College of Computing Degrees Awarded (Source)

Strategic Contraction: The Florida State Model

In stark contrast, Florida State University has pursued a fundamentally different approach:

FSU has deliberately reduced enrollment by 23.15% (7,619 → 5,855 students) while simultaneously cutting its acceptance rate by 12.8%.

This dramatic contraction represents perhaps the most explicit example of a public university leveraging artificial scarcity to boost its prestige metrics. By accepting fewer students from a growing applicant pool, FSU has engineered a rapid rise in selectivity that has coincided with significant improvements in national rankings.

The Yield Factor is Quality vs. Quantity

The enrollment strategies reveal important differences in how universities are measuring success:

- Yield Improvers: Purdue (+4.28% yield) and Georgia Tech (+3.98% yield) have managed to grow while becoming more selective and more desirable to admitted students—the enrollment management “triple crown.”

- Yield Challengers: Despite becoming more selective, University of Illinois (-0.46% yield) and University of Washington (-1.19% yield) saw slight declines in yield, suggesting they’re still working to convert selectivity into increased desirability among admitted students.

The New Strategic Playbook

These enrollment patterns reveal several emerging strategies in public higher education:

- Calculated Growth: Universities like Purdue have identified opportunities to expand in high-demand fields while still enhancing selectivity metrics that drive rankings.

- Engineered Scarcity: The FSU model demonstrates how deliberately constraining enrollment, with alternate admission programs or otherwise, can accelerate an institution’s prestige trajectory.

- Regional Differentiation: While some regions (Southeast, Mid-Atlantic) are seeing flagship contraction, others (Midwest, Northeast) are pursuing more balanced growth approaches.

- Multi-Campus Solutions: Several university systems are directing more students to satellite campuses and online programs, allowing their flagship campuses to become more selective while still fulfilling their access mission system-wide.

For state legislators and taxpayers, these trends raise important questions about the evolving mission of public higher education and whether the pursuit of prestige metrics has come at the expense of the access mission these institutions were founded to fulfill.

The Strategic Evolution

What’s clear from the data is that the era of organic, demand-driven enrollment at public universities has largely ended. Today’s flagship public institutions approach enrollment as a strategic variable to be optimized for institutional goals—whether those goals prioritize access, selectivity, tuition revenue, or some carefully balanced combination of all three.

These sophisticated enrollment management tactics allow universities to simultaneously pursue seemingly contradictory goals: becoming more selective while still growing revenue, enhancing prestige while maintaining some degree of accessibility, and competing with elite private universities while still fulfilling their public mission.

For students navigating this complex landscape, understanding these strategies has become essential. The traditional approach of simply applying to a state flagship is giving way to a more nuanced process that might involve considering spring admission, satellite campuses, or specific program pathways—all of which have different acceptance thresholds and requirements.

For state legislators and taxpayers, these trends raise important questions about the evolving mission of public higher education and whether the pursuit of prestige metrics has come at the expense of the access objectives these institutions were founded to fulfill.

Reimagining the Public University Mission

As our analysis demonstrates, America’s premier public universities are undergoing a profound identity transformation. The surge in applications, plummeting acceptance rates, and sophisticated enrollment strategies reflect institutions actively positioning themselves in an increasingly competitive higher education marketplace. For many, the pursuit of prestige metrics has superseded their historical commitment to broad educational access for state residents.

This evolution raises pressing questions about how public universities balance prestige with their historical mission to democratize higher education. As flagships become more selective than many private universities, the democratizing mission that shaped public higher education for generations is being redefined. Students—particularly middle-class students who once reliably gained admission to their state’s flagship—now face a drastically more competitive landscape with fewer predictable pathways.

State legislators, taxpayers, and university leaders must confront difficult questions: What is the proper balance between prestige and access? How can public universities maintain excellence while fulfilling their foundational mission to serve their states? And perhaps most importantly, as public flagships become increasingly selective and nationally oriented, who will educate the broad middle of American students who have traditionally relied on these institutions for social mobility?

How public universities navigate the tension between prestige and access will determine whether they remain engines of advancement or become enclaves of exclusivity. The answer will shape not just individual lives, but the future of American society itself.